Each entity is formed with a unique commercial address and EIN.

EIN, DUNS, commercial address

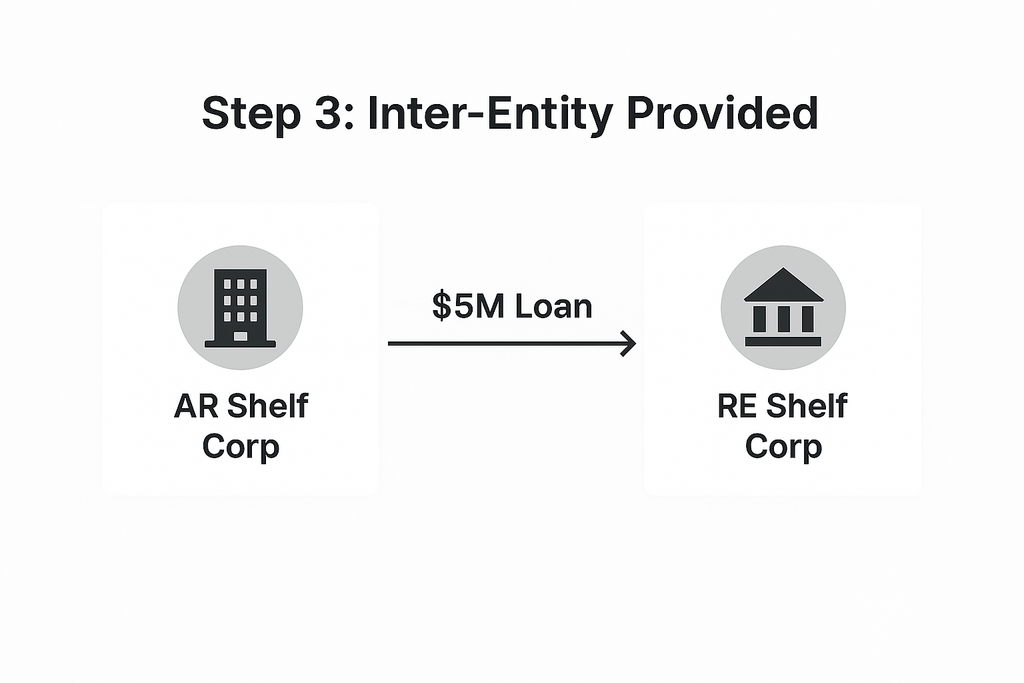

$5M in discounted receivables booked to balance sheet creating instant leverage for ABL funding.

Recovery initiated via Collections Agency

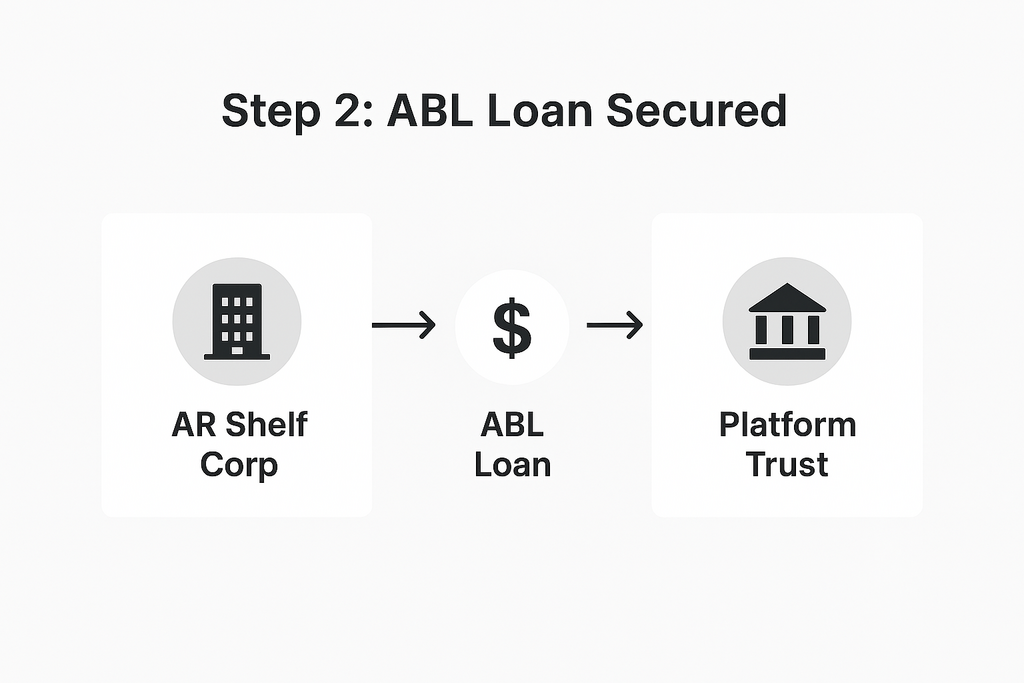

Each AR Shelf Corp applies for a $5M asset-based loan

ABL proceeds are lent to the Platform Trust

Real Estate Shelf Corp acquires a 4-plex in the Rio Grande Valley

Investor receives immediate payback from Platform Trust's first ABL draw